China Set To Produce Next-generation Smartphone Processors

Chinese chipmakers intend to produce next-generation Smartphone processors as early as this year despite U.S. efforts to curb their development of advanced technologies.

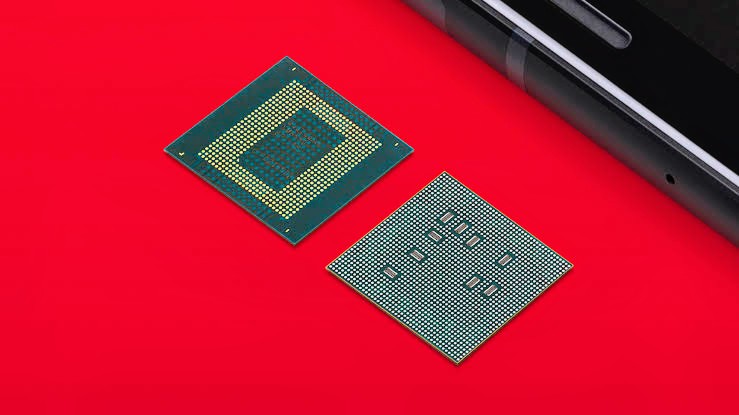

The country’s largest chipmaker, Semiconductor Manufacturing International Corp (SMIC), has set up new semiconductor manufacturing lines in Shanghai to mass produce Huawei-designed chips, according to the article, citing sources.

SMIC plans to leverage its current stock of US and Dutch-made equipment to create 5-nanometer chips, it said.

Washington prohibits U.S. corporations from giving technology to SMIC without a special license because its suspected collaboration with China’s military is deemed a danger to American national security.

Faced with these constraints, the Chinese government has made significant investments to build a self-sufficient semiconductor supply chain.

Also Read: China pledges continuous economic commitment to Nigeria

In 2023, the infamously cyclical semiconductor sector saw its eighth downturn since 1990, with sales predicted to fall 9.4% (to US$520 billion). However, this is not as severe as was projected in the spring; before a surprisingly robust second and third quarter, the earlier prediction was for US$515 billion.

Global revenues are expected to reach US$588 billion by 2024. That is not only 13% greater than in 2023, but also 2.5% higher than the industry’s peak sales of US$574 billion in 2022.

As is typically the case, the memory chip industry was the most influential element. Memory sales reached almost US$130 billion in 2022, accounting for little under 23% of the total chip industry, but fell 31% (approximately US$40 billion) in 2023.

The market is forecast to recover virtually all of that by 2024, with sales returning to 2022 levels. If we omit memory, the remainder of the industry fell in 2023, but only by around 3%.

In terms of end markets, PC and smartphone sales are predicted to increase by 4% in 2024, following 14% and 3.5% drops in 2023, respectively.

The semiconductor industry will most likely benefit from a return to growth in these two end markets: In 2022, communication and computer chip sales (including data center chips) accounted for 56% of total semiconductor sales.

Inventory and fab utilization are two additional key indicators of the industry’s health. As of fall 2023, inventories remained high, at more than $60 billion, around the same amount as the previous year. And the process of bringing those down will be a big drag on sales in the first half of 2024.

Furthermore, usage was high during the current shortage (in the mid-90% range) and is predicted to decline below 70% by Q4 2023. To be successful, the sector would most certainly require significantly increased utilization, which might take some time.

Reuters/Jane

Comments are closed.