The Abuja Chamber of Commerce and Industry (ACCI) has commended President Bola Ahmed Tinubu for signing into law four landmark tax reform bills.

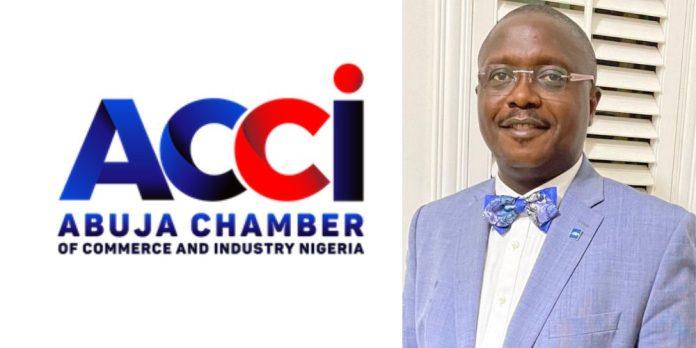

The President of the Chamber, Dr Emeka Obegolu, in a statement described the move as a bold and strategic step toward enhancing the ease of doing business, attracting investment, and establishing a fairer and more transparent tax regime in Nigeria.

He explained that the laws come at a crucial time when Nigeria is striving to build a more inclusive and investment-friendly economic climate.

“The business community fully supports the newly introduced policies, which are expected to reposition the country’s tax framework for fiscal sustainability and inclusive growth.

These laws aim to harmonise Nigeria’s tax system, streamline administration across federal, state, and local governments, eliminate multiple taxation, and improve compliance,” he affirmed.

The ACCI boss disclosed that one of the most transformative aspects of the reform is the exemption of small businesses with an annual turnover below ₦50 million from Company Income Tax (CIT), along with simplified filing requirements that eliminate the need for audited accounts.

“The upward revision of the CIT exemption threshold from ₦25 million to ₦50 million clearly demonstrates an intent to support and empower small businesses.

It is a progressive policy that recognises the challenges faced by SMEs and encourages a culture of growth and innovation,” Dr Obegolu stated.

He also applauded the planned reduction in corporate tax rates for larger companies, from the current 30% to 27.5% in 2025, and 25% in subsequent years, as a strategic move to boost investor confidence and enhance Nigeria’s economic competitiveness.

However, he expressed concern over certain provisions affecting professional service providers, calling for clarity and equitable enforcement to prevent unintended consequences such as increased informality or reduced tax compliance.

The newly enacted legislation includes the Nigerian Tax Bill (Ease of Doing Business), the Nigerian Tax Administration Bill, the Nigerian Revenue Service Bill, and the Joint Revenue Board (Establishment) Bill.