Libya has announced that it is offering 22 areas for oil exploration and development in its first bidding round in over 17 years.

This was disclosed by oil officials on Monday. The new round, launched on March 3, will feature production sharing agreements (PSAs) as the country aims to attract foreign investment and boost oil output.

READ ALSO: Libya Devalues Currency For First Time In Four Years

National Oil Corporation (NOC) Chairman Massoud Suleman told potential investors at an event in London that the blocks are evenly divided between onshore and offshore locations.

Currently, Libya’s crude production stands at around 1.4 million barrels per day (bpd), approximately 200,000 bpd below its pre-civil war peak, according to the NOC. The country is targeting a ramp-up in output to 2 million bpd.

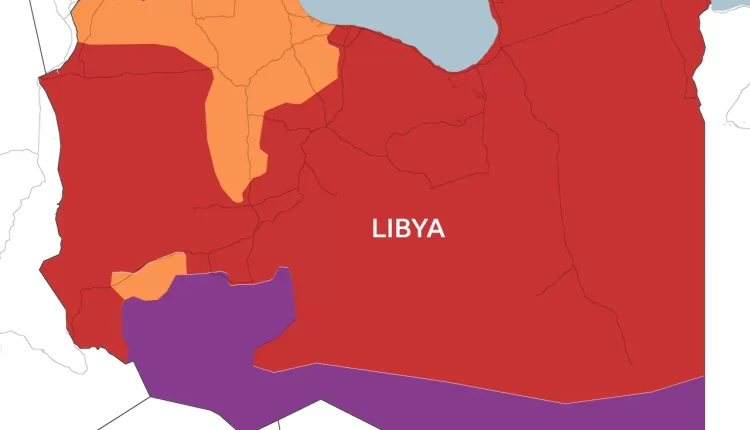

Foreign investment in Libya’s energy sector has been limited due to years of political instability and conflict following the 2011 overthrow of Muammar Gaddafi. Frequent disputes between rival armed factions have disrupted oil production and led to repeated shutdowns of key oilfields.

Libya’s Oil Minister Khalifa Abdulsadek said the acreage on offer spans some of the country’s most prolific hydrocarbon basins, including Sirte, Murzuq, and Ghadamis, as well as offshore areas in the Mediterranean.

In January, Abdulsadek told Reuters that Libya would need between $3 billion and $4 billion in investment to increase production to 1.6 million bpd.

A presentation by NOC officials revealed that the new round will adopt a Production Sharing Agreement model, replacing the stricter EPSA IV framework used in previous tenders, which had offered less favourable terms to investors.

Reuters

Comments are closed.