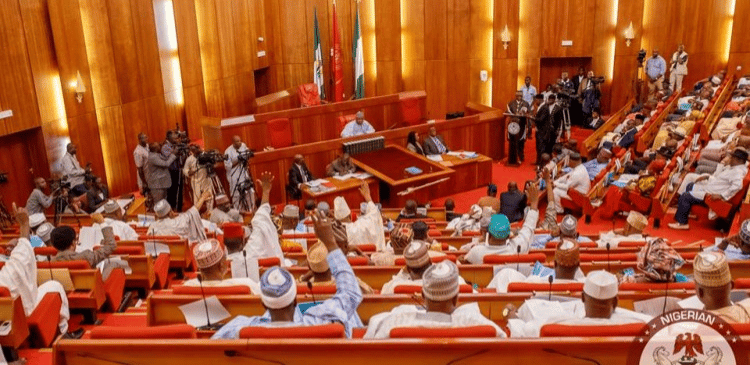

The Nigerian Senate on Thursday passed the four Tax Reform Bills for second reading through voice votes.

The bills are; the Nigeria Tax Bill 2024, which is expected to provide the fiscal framework for taxation in the country, and the Tax Administration Bill, which will provide a clear and concise legal framework for all taxes in the country and reduce disputes.

The others are; the Nigeria Revenue Service Establishment Bill, which will repeal the Federal Inland Revenue Service (FIRS) Act and establish the Nigeria Revenue Service, and the Joint Revenue Board Establishment Bill, which will create a tax tribunal and a tax ombudsman.

President Tinubu had on October 3, 2024, transmitted the four tax reform bills to the National Assembly for consideration.

The move generated controversy with the Northern governors kicking against the tax reforms.

Worried by the situation, the Presidency explained that the bills were not targeted at any particular region but to develop the country.

The Presidency also proposed legislation seeking to harmonize, coordinate, and resolve disputes arising from revenue administration in Nigeria.

The session saw lawmakers deliberating on the general principles of the tax reform bills.

Earlier, the Senate had gone into a closed-door session to discuss the four bills following the recommendations of the Taiwo Oyedele-led Tax Reforms Committee.

While the reforms were generally acknowledged as critical to overhauling Nigeria’s tax system and reducing the tax burden on citizens, Senator Ali Ndume expressed reservations about the timing and certain provisions of the bill.

He suggested that the reforms, with necessary amendments, could be passed “in less than 24 hours” if withdrawn and reintroduced.

However, the Chief Whip, Senator Mohammed Monguno strongly opposed this view, emphasizing the importance of advancing the bill to the public hearing stage.

“The bill should scale second reading and undergo thorough examination during the public hearing. Afterward, it can be subjected to clause-by-clause consideration”.

According to the only dissenting voice, Senator Ali Ndume: “Reforms are necessary, I am not against any reforms. My problem is the timing as it is today in Nigeria as we say I want to add to what Senator”.

“One will be at the public hearing and the issue of derivation because the Constitution has to be amended before some of the proposals of the Bill can be affected.

“This bill should be withdrawn, we work on it and submit it after getting the buy-in of the Governors,

“I looked at the bill and it contains so many but these two things VAT and Derivation. You negotiate first before we come to take a position.

“It looks attractive but it may not be what it is. If you move a tax burden to the manufacturer he will transfer it to the consumer.

“In the bill, we say a reduction from 30% to 25% which means that the person in Nnewi that is no longer able to make Billions, you are charging him with the same person that is just sitting down doing Nothing”.

In his remarks, the President of the Senate, Senator Godswill Akpabio said there will be public hearing on the Bills, where all relevant Stakeholders will be invited before further deliberations.

“The Bills will go into second reading, all the concern groups in the country will be invited for public hearing, the governors forum, the tradition institutions, the NGOs, etc, to be given opportunity for their inputs, at the end for our considerations” Senator Akpabio said.

President Tinubu Bola transmitted the four tax reform bills to the National Assembly for consideration on October 3.

Olusola Akintonde

Comments are closed.