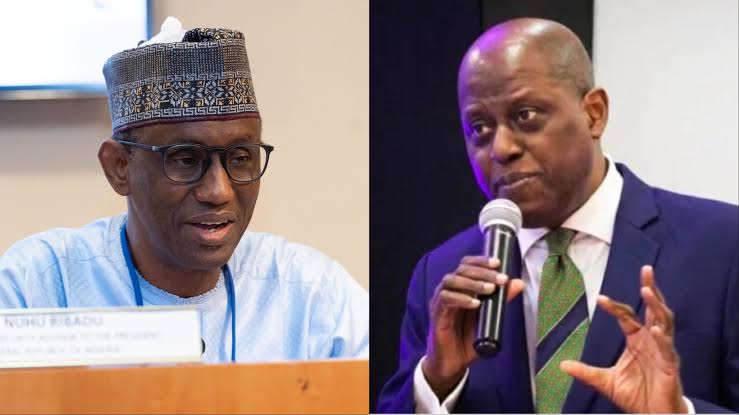

The Office of the National Security Adviser (ONSA) and the Central Bank of Nigeria (CBN) are joining forces to address challenges impacting the nation’s economic stability.

A statement by the Head, Strategic Communication, ONSA, Zakari Mijinyawa, said the partnership was aimed at safeguarding Nigeria’s foreign exchange market and combat speculative activities.

The statement said; “The CBN’s proactive measures to stabilise the foreign exchange market and stimulate economic activities have been commendable, the effectiveness of these initiatives is being undermined by the activities of speculators.

“This speculators are both domestic and international, operating through various channels, thereby exacerbating the depreciation of the Nigerian Naira and contributing to inflation and economic instability and hardship on citizens.”

“The CBN had in a move to address the exchange rate volatility initiated a comprehensive strategy to enhance liquidity in the forex market, including unifying FX market segments, clearing outstanding FX obligations, introducing new operational mechanisms for Bureau De Change operators, enforcing the Net Open Position limit for commercial banks, and adjusting the remunerable Standing Deposit Facility cap,” it said.

The Economic and Financial Crimes Commission (EFCC) has also raised a 7,000-man special task force across its 14 zonal commands to clamp down on dollar racketeers to reduce the pressure on the naira. But inspite of all these efforts, recent intelligence reports have highlighted continued illicit activities within the Nigerian foreign exchange market.

The ONSA and CBN are therefore embarking on this collaborative approach to tackle the highlighted infractions.

The partnership according to the statement from the ONSA “will involve a coordinated effort with key law enforcement agencies, including the Nigeria Police Force (NPF), the Economic and Financial Crimes Commission (EFCC), the Nigeria Customs Service and the Nigeria Financial Intelligence Unit (NFIU).”

The statement said; “The primary objective of this alliance is to systematically identify, thoroughly investigate and appropriately penalise individuals and organisations involved in wrongful activities within the FX market.

“This will be done by leveraging the expertise of these agencies, with the aim of deterring malicious practices, protect investor interests, and promote sustainable economic growth.”

It said; “The joint effort is the Nigerian government’s commitment to improving its Anti-Money Laundering and Counter Financing of Terrorism (AML/CFT) framework and exiting the grey list of the Financial Action Task Force.

“In addition, the efforts will make progress in ensuring a stable and transparent foreign exchange market, fostering investor confidence, and advancing the nation’s economic well-being.”

Mercy Chukwudiebere

Comments are closed.