African leaders have been urged to form a negotiation bloc while negotiating debt payment with Western countries.

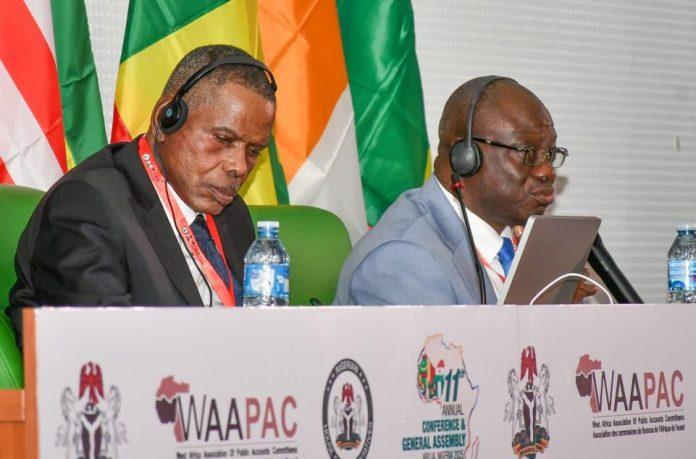

This was the consensus at a panel discussion on the second day of the 11th Annual Conference and General Assembly of the West Africa Association of Public Accounts Committees, WAAPAC, ongoing in Abuja.

The panel agreed that when African countries come together to hold discussions with bigger countries, they would achieve more positive outcomes than when they negotiate individually.

One of the panellists from Cameroon, and the Policy Research and Advocacy Manager at AFRODAD, a non-governmental organisation, Mr. Yungong Tong, said that the organisation has been working with national assemblies in building capacity.

He said that he hopes to take the engagement forward in a more concrete partnership that would ensure the building of an accountability partnership.

He also urged WAAPAC to work with the media to communicate its activities to the citizens.

“Working with the media is very important. I think it connects to engaging the citizens because the citizens have a very important role to play,” Mr. Tong said.

He added that he expects that at the end of the conference, a network will be created for the continuous, accountable debt management in Africa.

Similarly, the Director General of the Debt Management Office, Ms. Patience Ohima, said that public debt has in the last eight years increased in West Africa.

She said that the COVID-19 pandemic era expanded the physical deficit, which led to more West African countries borrowing.

She pointed out that the largest borrowers in the region since 2020 are Nigeria, Ghana, the Ivory Coast and Senegal.

The Director General, who was represented by Maryam Omar, said that the rising debt burden threatens debt sustainability and overall microeconomic stability of the region.

” As a result of the global interest rate hike and the tightening of the monetary policies, there has been an increase in the cost of borrowing, especially from domestic sources.

Also, there is a weak domestic capacity, and there are data gaps in terms of the reliability of data. You see, agencies have conflicting data on the same issue,” she said.

She added that to address the challenges, Africa needs sound and robust public debt management and the strengthening of data systems.

In his presentation, the Nigerian Auditor-General for the Federation, Mr Shaakaa Kanyitor Chira, said that the office has a sound relationship with the Public Accounts Committee of the National Assembly.

He said that the Auditor General’s report has been foundational for the activities of the PAC.

In a paper titled “Parliamentary Approaches To Loan Agreements: Approval, Scrutiny And Disclosures in Nigeria”, a former lawmaker, Mr. Ossal Nicholas Ossai, said that the conference was a timely and urgent conversation, as Nigeria grapples with complex loan agreements and the need for greater transparency and accountability in public finance management.

He highlighted the Legal and Institutional Frameworks Governing Loan Oversight in Nigeria and parliamentary entry points in the loan agreement process. Key Roles of the Key Committees Involved in Loan Oversight, The dynamics of executive-legislative interaction in Nigeria’s debt governance framework, challenges in parliamentary oversight of public debt in Nigeria, and recommendations for strengthening parliamentary oversight.

“As Nigeria’s public debt continues to grow, reaching over $97 trillion as of mid-2025, concerns around transparency, sustainability, and accountability in loan acquisition have taken centre stage in public policy discourse. A critical yet often underemphasised aspect of debt governance lies in the role of the legislature, particularly through the Finance and Public Accounts Committees, in the approval, scrutiny, and disclosure of loan agreements.

‘These parliamentary mechanisms are essential for ensuring that borrowing decisions are not only lawful and economically sound but also aligned with national development priorities and the interests of future generations,” he said.

Mr. Ossai added that through public hearings, briefings, and budget defence sessions, the PAC and Finance committees exercise their powers to scrutinise borrowing decisions.

“However, the effectiveness of this system depends largely on the capacity, autonomy, and political will of the committees involved,” he added.