Kano State Governor, Abba Kabir Yusuf, has reaffirmed its commitment to partnering with the Federal Mortgage Bank of Nigeria (FMBN) to boost housing development across the state.

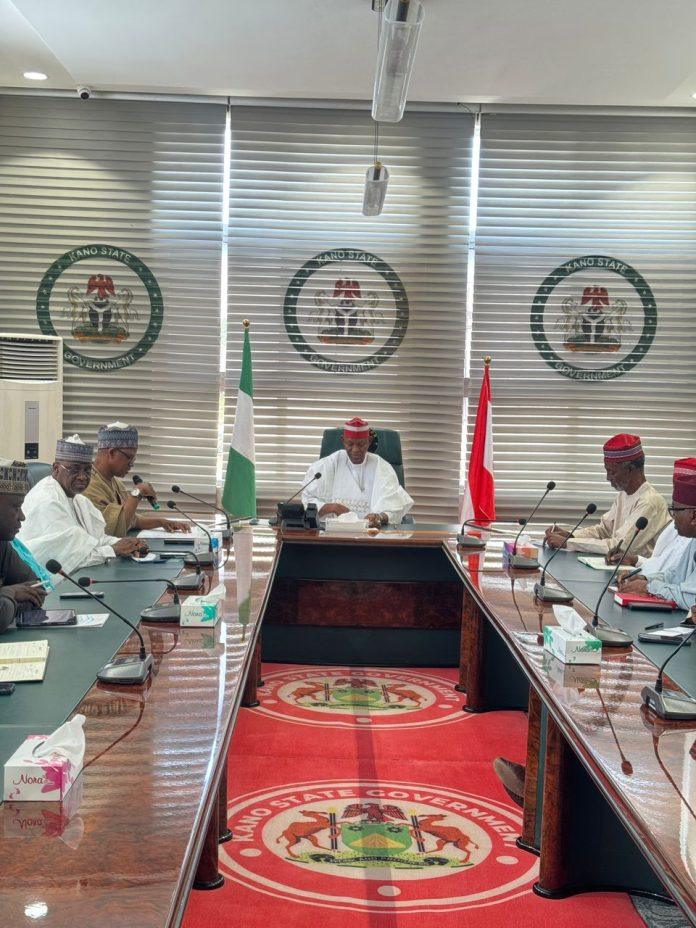

Governor Abba Kabir Yusuf disclosed this while welcoming the Managing Director and Chief Executive Officer of the Federal Mortgage Bank, Alhaji Shehu Osidi, along with his team during a courtesy visit to the Government House.

According to a statement issued by the Governor’s Chief Press Secretary, Mustapha Muhammad, the Governor emphasized the critical need for the partnership, citing Kano’s status as the second most populous state in the country and the growing demand for affordable and livable housing.

“Kano State has always been at the forefront of developmental initiatives, and housing remains a vital pillar of our agenda.

We understand the significance of accessible and affordable homes in improving the quality of life for our people.” Governor Yusuf stated.

He added that, his administration believes in a collaborative approach with relevant agencies like FMBN and other stakeholders to meet the housing needs of Kano’s growing population.

In his remarks, Chief Executive Officer of the Federal Mortgage Bank Alhaji Shehu Usman Osidi said his visit was aimed at formally introducing himself and exploring areas of strategic collaboration with the Kano State Government.

He reiterated the Federal Mortgage Bank’s core mission of supporting Nigerians particularly low and middle-income earners with opportunities to own decent and affordable homes.

“We commend the Kano State Government for its recent decision to reinstate civil servants into the National Housing Fund Scheme.

This reflects a responsive and people-centered leadership committed to workers’ welfare,” he said.

Osidi disclosed that the bank is currently financing ten housing projects across various parts of the state, valued at over ₦6.8 billion, as part of efforts to address Kano’s housing deficit.

He assured of the bank’s readiness to strengthen collaboration with the state to ensure the success of housing development initiatives.

Victoria Ibanga